Okay, so it’s tax season again, and as an F1 student, I gotta file my taxes. It’s always a bit of a headache, but this year I decided to really document the process so I don’t have to scramble next time. Here’s how I tackled it, step-by-step, in plain English.

Figuring Out My Status

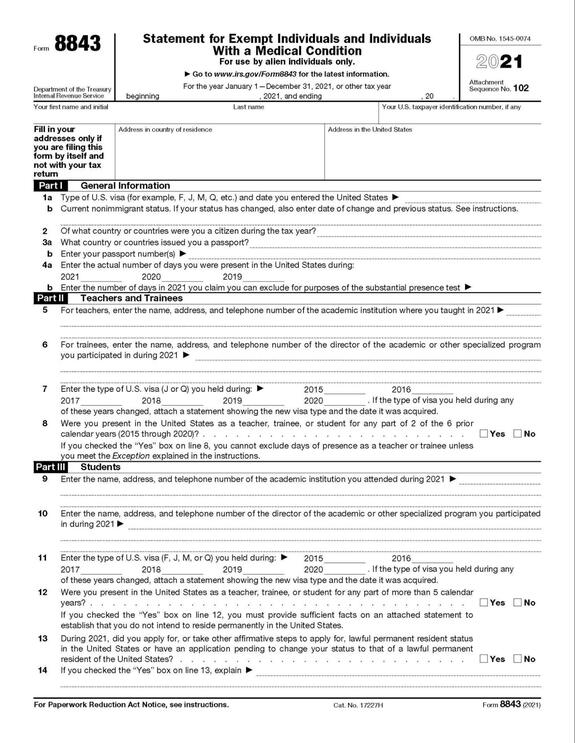

First thing I did was figure out if I was considered a resident or nonresident alien for tax purposes. This is super important because it changes everything. Turns out, since I’ve been in the US on my F1 visa for more than 5 years, I’m considered a resident alien for tax purposes. If you have not passed five years yet, then you are probably a nonresident alien. This “substantial presence test” thing on the IRS website helped me figure that out, there is a series of questions, and you just need to answer them.

Gathering All My Documents

Next, I gathered all the documents I needed. This was kind of a pain, but I made a checklist so I wouldn’t miss anything:

- Form W-2: My university sent me this, it had info on my income and taxes withheld.

- Form 1098-T: Also from my school, showing tuition payments.

- Form 1042-S: If I had any scholarships, fellowships, or grants, I’d get this form. I didn’t this year, phew.

- Passport and Visa: Just to have all my info handy.

- I-20: Proof of my F1 status, you know.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): I already had my SSN from on-campus employment. If you don’t have one, you’d need to apply for an ITIN using Form W-7.

- Bank account statements.

Choosing How to File

Now, I had to decide how to file. I’m not gonna lie, I’m not a tax expert. I had a couple of options:

- Use a tax software designed.

- Go for those free tax filing services.

- Fill out all these paper forms from IRS website. I even considered hiring a tax professional, but I wanted to save some money.

I have decided to go with tax software.

Actually Doing the Taxes

So, I started filling out the forms. Since I’m a resident alien for tax purposes, I used Form 1040, just like US citizens. It took a while, and I had to double-check everything to make sure I didn’t mess up.

I went through each section of the form, plugging in my income, deductions, and any credits I qualified for. The software helped a lot, it asked me questions and did most of the calculations for me. I made sure to report all my income, even the small amount I made from my on-campus job. The software helped a lot, it asked me questions and did most of the calculations for me.

Submitting Everything

Once I was sure everything was correct, I e-filed my return through the tax software. It felt good to get that done! I also made sure to print out a copy of my return for my records. I have to mail a few forms to a specific address. But, you just do everything software told you to do.

Keeping Records

Finally, I organized all my tax documents and stored them in a safe place. I know I need to keep them for at least three years in case the IRS has any questions. You know, always gotta be prepared.

That’s it! That’s how I filed my taxes as an F1 student this year. It wasn’t super fun, but it’s done. Hopefully, this breakdown helps someone else out there. Remember, I’m not a tax professional, so this is just my personal experience. If you’re unsure about anything, it’s always a good idea to consult with a tax advisor or check the IRS website. Good luck!